He Mocked a Customer—Then the Man Pulled a CEO Badge

A bank manager mocked a quiet customer for wanting cash… But the “humble man” slid a CEO badge across the counter and everything changed. Full story in the comments.

The lobby smelled like disinfectant and warm bread. The clock hit nine; the line moved like a slow river. He waited with a simple ticket in his hand.

“Next,” the teller called.

“Good morning,” she said, eyes tired. The man smiled like it was the most natural thing.

Ramiro stepped out of the glass office and planted himself like he owned the room. “What do you want, sir?” he asked, voice sharp as a paper cut.

“I need to withdraw some money,” the man answered, calm and precise.

Ramiro laughed loud enough to draw eyes. The laugh was not warm. “If you have credit… I’ll pay you double!” he announced, mocking, like he’d delivered a punchline.

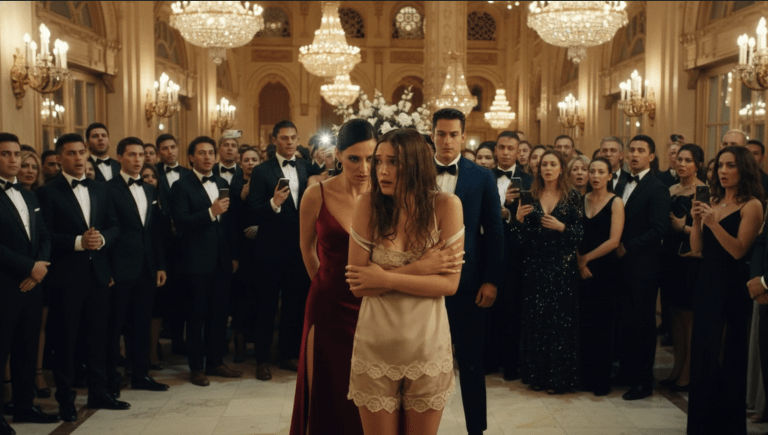

The room blinked. Phones paused. People shifted their weight. The old woman clutching her purse swallowed hard.

“I expected nothing less from you,” the man said, soft but steady.

Ramiro’s smirk widened. He expected a flinch. He expected a retreat. The man reached into his pocket, took out a metal card, and set it on the counter.

The teller’s fingers brushed it. “Sir…” she breathed.

Ramiro leaned in. “System error,” he muttered, proud of the excuse.

The screen flashed the name. The word hit the room like a bell.

“CEO. Chief Executive Officer.”

Silence, then a low ripple of whispers. The cashier’s face drained. Her lips trembled. “Mr. Salvatierra—Ramiro—that’s the branch manager,” someone hissed.

Ramiro went white. “That’s impossible,” he said, voice small for the first time.

The CEO watched him for a long moment. “You have a lot to explain,” he said.

Ramiro tried to laugh it off. “This is ridiculous. You’re—this has to be a joke.”

“Is it?” the CEO asked, voice flat. “Do you want me to check the security footage? The transaction logs? Or would you prefer I call our compliance office?”

Ramiro’s jaw tightened. He straightened, trying to reclaim the room. “You can’t walk in here—”

“Watch me,” the CEO replied.

“Who are you?” the old woman demanded, voice shaking.

“Name’s David Archer,” he said. “I run this bank.”

A young man near the door snap

Ramiro barked at a junior teller. “Call security. Now.”

“You’re not in charge here,” David said. “I’m placing this branch under immediate review.”

Ramiro stepped forward, voice low and dangerous. “I run this branch. People respect me. I won’t—”

“Then tell these people why you told Mrs. Garrity her mortgage papers were incomplete and then processed a loan for a developer you personally approved,” David interrupted, cutting him off.

Heads turned. Confusion bloomed into outrage. “That’s not true,” Ramiro stammered.

“Is it true that you flagged low-credit applicants until they missed payments so you could sell their defaulted loans to a collector for a kickback?” David asked.

“You’re making accusations,” Ramiro said. He reached into his jacket. Everyone tensed.

“Don’t touch anything you’re not entitled to touch,” David said quietly.

There was a pause like a held breath. Then David spoke up, voice low but clear. “I authorized a forensic audit last month after several complaints. This branch has the highest complaint rate in our region. I came in disguise because I wanted to see how you ran things when you thought you could set the tone.”

Ramiro’s face hardened. “You wouldn’t understand. Business is contacts. You get results.”

“By breaking people’s lives,” David said. “By forging signatures, by altering payment schedules, by telling customers they had no options. That’s not results. That’s theft.”

A teller whispered, “We filed reports. They were ignored.”

“HR’s inbox shows your filter,” David said. “You buried complaints under ‘low priority.’ You used branch funds for personal expenses. You moved mortgage applications to the bottom if the applicant was ‘too messy.'”

Ramiro laughed, but it sounded like a cough. “You can’t prove—”

“We can.” David placed a slim tablet on the counter and tapped it. A video opened: footage of Ramiro speaking to a teller, his voice cold. “No mercy on the mortgages with those names. Let them default. We cut our losses and the bank sells the bundle.”

“It was strategy,” Ramiro spat.

“A criminal scheme is not strategy,” David said. “It’s a crime.”

A woman in the line pushed forward. “My son—he got a denial last year. You told us to try again in six months. We never heard back. We lost the house.” Her voice cracked.

Ramiro’s eye twitched. He swallowed. “There are procedures—”

“We’ll follow them,” David said. “Starting now. Compliance is here.” He looked at the teller. “Lock the vault. Freeze the branch admin privileges for Ramiro Salvatierra.”

“You can’t lock me out of my own systems!” Ramiro protested.

David slid his card through the reader. The system accepted it. The display turned red beside Ramiro’s name: ACCESS REVOKED.

“You think you run things, but you only ran what you could hide,” David said. “We found email chains with you and a third party. Payments labeled ‘advertising’ that went to your personal account.”

Ramiro’s face flushed. “That’s—those are accounts payable. There’s no proof.” He was grasping at air.

“Proof’s on the server,” David said. “And we have witnesses.”

A junior teller stepped closer. “You told us to add fees and not tell customers so the branch numbers looked good,” she said. “We did it because we were scared of losing our jobs.”

“Then go to the auditors,” Ramiro snarled. “You think they’ll believe you?”

David lifted his hands slightly, not in surrender but to invite truth. “Every one of you will be protected. Compliance will take statements. The internal investigators will review every file in this branch for the last three years.”

Ramiro’s voice dropped. “You can’t ruin my career on rumors.”

“This isn’t rumors,” David said. “It’s documented. And it’s cost people their homes, their credit—”

“My mortgage is ruined because of you,” the old woman said. “My granddaughter can’t go to college because of fees you pushed through.”

Ramiro found a last scrap of bravado. “You have no idea what numbers take to run a branch. You hide in glass offices, Mr. Archer. You don’t know the pressure.”

David’s face didn’t change. “I used to stand in line like you, too,” he said. “I remember what it felt like to be told no because someone decided you were unworthy of help.”

There was a small, stunned silence. The teller who had scanned the CEO’s card asked, “What happens now?”

“Ramiro is suspended,” David said. “Human Resources will take him in. Police will be notified if the auditors find criminal activity. We’ll make restitution where it’s due. We’ll publicly notify affected customers and correct their records.”

“You’re going to announce this?” someone asked.

“To the customers who were harmed, yes,” David replied. “And to our regulators if necessary.”

Ramiro’s mouth opened. “You can’t—”

“Watch me,” David said.

He spoke with quiet efficiency. “Security, escort him to the manager’s office. HR on line one. Compliance team, meet me in the office now. Notify the regional director.”

Ramiro’s face collapsed into something smaller than a smirk. “You can’t do this to me. I put this branch on the map.”

“You put it on the map by hiding bodies,” David said. “And you will answer for it.”

Ramiro lunged, reckless and desperate. Security moved faster. Two guards closed ranks, hands gentle but firm on his elbows. “Mr. Salvatierra, you’re suspended pending an investigation,” one guard said.

“You’re making a scene,” Ramiro hissed.

“You’re already making one,” David replied. “This is the right one.”

The crowd murmured as they watched the manager’s fall. Phones captured it all. The lobby felt smaller now, like a theatre after the curtain drops.

An older man, a regular who always took his coffee at the corner café, stepped up. “About time,” he said. “My account was charged seven times for the same teller count last month. You laughed when I complained.”

“I’m sorry,” the teller said, voice trembling. “We were told not to escalate.”

David looked at her and then at the old man. “Bring me your statements,” he said. “We’ll reconcile. If your credit was harmed, we will repair it. We will write letters to the credit bureaus. We’ll adjust mortgage timelines, and we will refund improper fees.”

“Will you press charges?” the woman with the mortgage asked.

“If evidence supports it,” David answered. “Yes. There will be criminal referrals.”

Ramiro was still struggling, trying to reclaim control. “You think this proves anything? You walk in here like—”

“I walked in because people were telling me things,” David said. “I read the logs. I saw patterns. I came to see if one person could make a branch corrupt. Turns out one person can do a lot of damage.”

A reporter in a gray coat, who had been waiting outside on a tip, had slipped in and was scribbling into her notebook. “Is the bank investigating systemic issues?” she asked, pen poised.

“We are conducting a full review,” David said. “This branch is the first step. We will cooperate with authorities.”

“Do you plan to fire other staff?” the reporter asked.

“We will hold individuals accountable,” David replied. “But we will also acknowledge where the system failed to catch behavior sooner. That’s on me.”

That line landed. People shifted, some nodding as if relieved that blame wasn’t being placed on underlings alone.

Ramiro’s face contorted. “You’re making me a scapegoat!” he spat.

“No,” David said. “You’re making yourself accountable.”

He turned to the line of customers. “If anyone here wants to file a statement now, HR is ready. If you prefer privacy, call our hotline. We’ll assign a case manager.”

Hands rose slowly. A woman in scrubs said, “My credit score dropped after they sold my loan. I was denied an apartment.”

“Come with me,” David said. “We’ll fix this.”

The junior teller who had scanned the CEO’s card was still shaking. “I just followed orders,” she whispered.

“You followed fear,” David answered. “We will protect you if you tell the truth. We’ll train staff to speak up. We’ll create a whistleblower hotline that truly works.”

Ramiro’s protests thinned as he was led away. Outside the branch, the afternoon traffic moved indifferent. Inside, people began to breathe in a different way.

“Do you want to say anything?” a compliance officer asked, recorder already on.

Ramiro opened his mouth, then closed it. “No,” he said at last. “I… I misjudged—”

“You misjudged people’s lives,” David said. “That’s on record now.”

The police arrived an hour later. They took statements, photographed records, and sealed some documents. Ramiro’s car, parked in the lot, was noted in the report.

By evening, emails had gone out to regional offices. David’s message was short and public: we will do better. The press release framed it as accountability and immediate corrective action.

The next morning, the branch was crowded again, but not with the same tension. People came with folders and statements. Some came only to see the man who had exposed them.

An old woman, the one who had clutched her purse, stood before David. Her eyes were wet. “You don’t know what losing credit does to a person,” she said.

“I do,” David replied. “My first business failed. I remember hand-signing a loan application and being told I was less than a number.”

She gripped his hand. “Thank you.”

“You deserve better,” he said.

Ramiro was placed on administrative leave pending the criminal audit. The bank announced a restitution program for affected customers and a full administrative overhaul at the branch. HR issued promises; compliance promised transparency.

Weeks later, the report arrived. It detailed forged signatures, unauthorized fees, misrouted mortgage applications, and diverted branch funds. Ramiro was charged with fraud and embezzlement. The bank terminated him. Prosecutors filed charges; civil suits followed.

On the day of the hearing, Ramiro sat in a courthouse hallway, face pale and thin. Cameras were outside. He was no longer a man in a suit who could command a room; he was a defendant.

David watched from the back bench as the judge read the findings. The judge ordered restitution to a list of victims and a recommendation for criminal prosecution. “This court finds the breach of trust was substantial,” the judge said.

Ramiro’s lawyer whispered. “We will appeal.”

“You can appeal,” the judge replied. “But you can’t undo.”

Outside the courthouse, some of the customers who’d been wronged gathered. They’d brought copies of their new, corrected statements. One by one, they turned to the cameras.

“He lied to us,” said the café owner. “We lost money.”

“They gave me fees and never told me why,” said the nurse who finally got a corrected mortgage. “Now it’s fixed.”

A graduate student whose credit had been damaged spoke softly, “I have my loan for community college again.”

Ramiro watched, expression hollow. A man once lifted by the sway of office power now witnessed the people he’d harmed reclaim small parts of their lives.

David stepped forward, not to gloat but to close the story. “This should never have happened,” he told the press. “We will rebuild trust. We will make restitution. We will change policies to prevent one person turning a branch into a predatory machine.”

“Will there be charges?” a reporter pressed.

“Yes. Where evidence supports criminal action, we will cooperate fully,” David said.

When the case went to trial months later, Ramiro pleaded guilty to several counts. He accepted a sentence that included restitution, community service, and, importantly, a published apology and an order that he refrain from any fiduciary role for a term beyond the sentence. The judge’s sentence emphasized public accountability: “You took advantage of trust placed in you. You will now be accountable for repair.”

The day the restitution checks were distributed at the branch, the lobby filled with faces then and still. The old woman who had clutched her purse cried as she signed the receipt. The student got a letter from the financial aid office confirming her now-correct credit. The café owner got a check that covered several months of lost revenue.

Ramiro watched from a bench across the street as people reclaimed pages of their lives. He had fought to hold on to a reputation sewn with shortcuts, and when it unraveled, he had no safety net.

“You did the right thing,” the teller who had scanned the card told David quietly as they closed the branch that evening. “You could have hidden it.”

“I couldn’t,” David said. “Not now. Not when it mattered.”

She looked at him. “Why did you come yourself?”

He thought of the small businesses, the students, the old women. “Because someone walked into a bank once and was told no until they forgot their face. I didn’t want that to be our story.”

Weeks later, rails of reform at the bank shifted. New training rolled out. An independent hotline was launched. Branch audits were randomized. Compliance got teeth.

Ramiro’s name was in headlines for a while—judge, scandal, restitution. Court records were public. He found doors closed; positions he once took for granted were denied. Some called it justice. Others called it necessary consequence.

On a late afternoon, as snow began to whisper from a gray sky, David stood outside the same branch. He watched a mother come in with a baby, the clerk smile, and a man step forward to hold the vestibule open. The place smelled of disinfectant and fresh bread again, but now the air felt lighter.

A woman approached him, keys in hand. “You fixed my credit,” she said. “My son got into community college because of that.”

“Good,” David said. “I’m glad.”

She hesitated. “Are you the same David Archer from before?”

He smiled. “Yes,” he said. “And I’m still learning.”

She laughed softly, then thanked him again. He watched her leave and felt vertigo ease into something like relief.

Months later, his phone rang. It was the head of compliance. “The regional directors want to adopt the branch’s corrective plan nationwide,” she said.

“Do it,” he replied.

At home that night, he set his metal card on the table. It looked the same as ever: embossed logo, weight that belonged to authority. He thought about the old woman clutching her purse, about the student with corrected records, about the small acts that make a life possible.

In court, Ramiro had paid the price. The law closed a chapter on his behavior. The bank changed the system he had exploited. The people who suffered got restitution and a public acknowledgement.

Ramiro, once a man of private humiliations and public power, now lived with the consequence. He learned the hard way that authority without accountability is a dangerous thing.

And in the bank, a poster went up: “We listen. We act. We repair.” It felt like a promise more than a slogan.

One day, months later, as customers moved through the lobby in their everyday rhythms, a small group paused to clap when David walked past. He nodded, briefly and matter-of-fact.

Ramiro, watching from across the street at a bus stop, looked down at his hands. The money he’d spent on power couldn’t buy back the trust he’d stolen.

The cameras that had recorded his downfall remained in the branch, silent witnesses. They had captured a manager who thought himself untouchable and a man who refused to accept being unseen.

Justice had been served in a public ledger: charges filed, restitution paid, a sentence read aloud, a fired manager escorted out. People repaired what they could. The community, bruised but steady, moved forward.

On the last page of the internal report, compliance had written one line as a lesson: “Power without conscience becomes predation.” It circulated through the bank’s offices and found its way into training sessions.

At the final staff meeting, David stood before clerks and managers, his voice firm. “This isn’t about one show trial,” he said. “It’s about building a bank that serves people, not profits at a human cost.”

That afternoon, as the branch lights dimmed and the last customers left, the CEO turned off the display screen and locked his office door behind him. He paused, hands on the brass handle, and for the first time in months felt a quiet he hadn’t expected.

Outside, Ramiro’s car was gone. His name had been scrubbed from company directories. The hole he’d left was not empty; others had stepped into roles with fresh guidelines and reminders of duty.

The city moved on. The bakery down the block reopened a counter window. The old woman collected her mail with a new spring in her step. The student walked the campus with books that had almost been lost.

When the story closed, there was a ledger entry, a court docket, and a chorus of small restitutions. The man who had once been scorned by a manager now held a card that opened doors and also closed a chapter.

Ramiro’s fall was public. The law had named what he’d done. The bank had repaired damage and put systems in place to stop it from happening again. People who had feared they’d been invisible found their names on corrected forms and renewed timelines.

The final note belonged to justice: restitution paid, job lost, criminal consequence accepted. The community’s breath, once constricted, released.

David folded his hands on his desk, felt the weight of the badge on the table, and allowed himself a small, private exhale. The bank would never be perfect, he knew. But that day, an honest ledger had been balanced.